Kenya’s mobile money breakthrough, led by M-Pesa, has reshaped not only its own economy but also influenced financial systems across Africa. Launched in 2007, M-Pesa made it possible for people to send, receive, save, and borrow money using basic mobile phones — without needing a traditional bank account.

Expanding Financial Inclusion

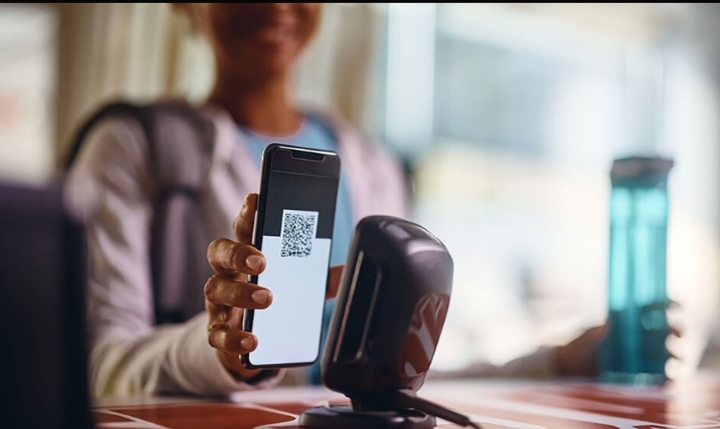

Before mobile money, millions of Kenyans lacked access to formal banking. Today, mobile wallets have dramatically increased financial inclusion, allowing people in ruraland low-income communities to participate in the economy. With just a phone, users can pay bills, transfer funds, and access credit services.

Empowering Small Businesses

Mobile payments have been especially transformative for small and informal businesses. Traders and entrepreneurs can now accept digital payments, manage transactions more efficiently, and access microloans. This has strengthened local commerce and boosted grassroots economic growth.

Driving Economic Growth

Mobile money has become a major contributor to Kenya’s GDP by formalizing previously cash-based transactions and improving transparency. Governments can deliver aid directly to citizens, while businesses benefit from safer and faster transactions.Influencing the ContinentKenya’s success has inspired similar systems across Africa, where mobile money is now a key driver of cross-border trade and digital finance. Sub-Saharan Africa leads the world in mobile money adoption, signaling a broader shift toward digital economies.

While challenges such as cybersecurity risks and regulatory concerns remain, Kenya’s mobile payment revolution has fundamentally changed how Africans interact with money. It has empowered individuals, strengthened entrepreneurship, and laid the groundwork for a more connected and inclusive economic future across the continent.