Africa’s startup ecosystem is rapidly evolving, with various trends shaping its growth. Here’s an overview of the current state of African startups in the global market:

Funding Trends

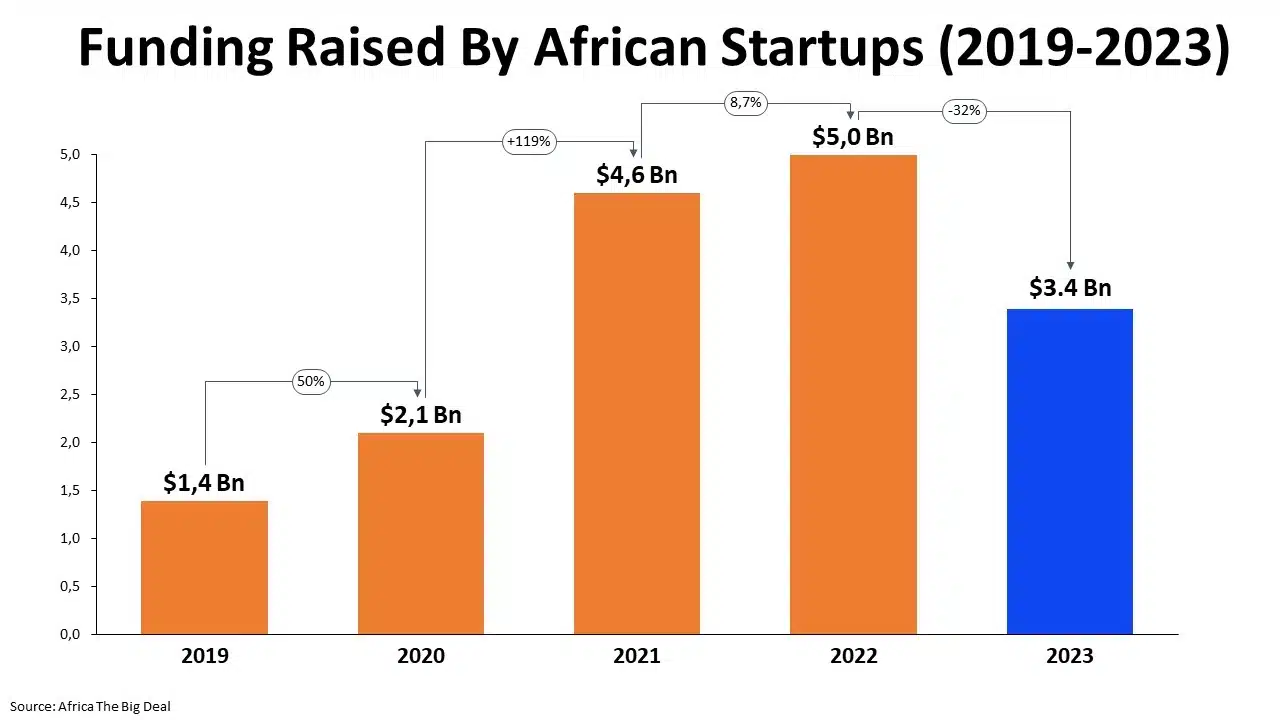

African startups raised $2.2 billion in funding in 2024, accounting for 0.6% of the total $275 billion global startup funding. Although this represents a significant funding gap, Africa has shown long-term resilience, with startup funding growing 62% since 2020. The majority of funding (83.27%) went to the “Big Four” – Kenya, Nigeria, Egypt, and South Africa. However, emerging markets like Ghana, Tanzania, and Uganda experienced impressive growth, indicating the rise of new secondary hubs ¹ ².

Sectoral Trends

Fintech Dominance

Fintech remains the leading sector, securing $1.04 billion in funding in 2024. Digital banking solutions, payment infrastructure, and credit services drove this dominance. Notable deals include Moniepoint’s $250 million Series C and TymeBank’s $110 million Series D.

Logistics and Transport

Logistics and transport ranked third in funding, with investors showing interest in solving Africa’s supply chain inefficiencies.

Climate Tech and AI

Despite growing global focus on climate-related investments, climate tech and AI ventures struggled to attract substantial capital, indicating an opportunity gap in sectors that could drive long-term innovation ².

Mergers and Acquisitions

Africa’s startup ecosystem witnessed a 34% year-over-year increase in mergers and acquisitions (M&As) in 2024. The fintech sector accounted for the largest share of deals, reflecting its growing maturity. Notable acquisitions include the Wasoko and MaxAB merger, creating Africa’s largest B2B e-commerce platform.

Regulatory Trends

Governments are introducing regulations to balance innovation with consumer protection. The African Union launched a Continental AI Strategy, while countries like South Africa, Nigeria, and Kenya introduced national AI policy frameworks. Stricter regulations are expected in 2025, particularly in healthtech, agritech, and creative industries ².

Outlook for 2025

Africa’s tech ecosystem is expected to maintain strategic consolidation, with increased M&A activity and a focus on profitability. Climate tech investments are set to rise, particularly in renewable energy and agri-tech. Startups will need to navigate regulatory challenges and explore alternative funding sources to sustain growth ².

Opportunities for African Startups

- Apply for the Tony Elumelu Foundation (TEF) Entrepreneurship Programme, which provides $5,000 in seed capital, mentorship, and business training.

- Explore debt financing, grants, and alternative funding sources to sustain growth.

- Leverage strategic partnerships and acquisitions to expand market share and improve operational efficiencies.

Overall, African startups are navigating a complex global market landscape, with opportunities for growth and innovation in various sectors. By understanding these trends and adapting to changing regulatory environments, startups can position themselves for success and contribute to the continent’s economic development.